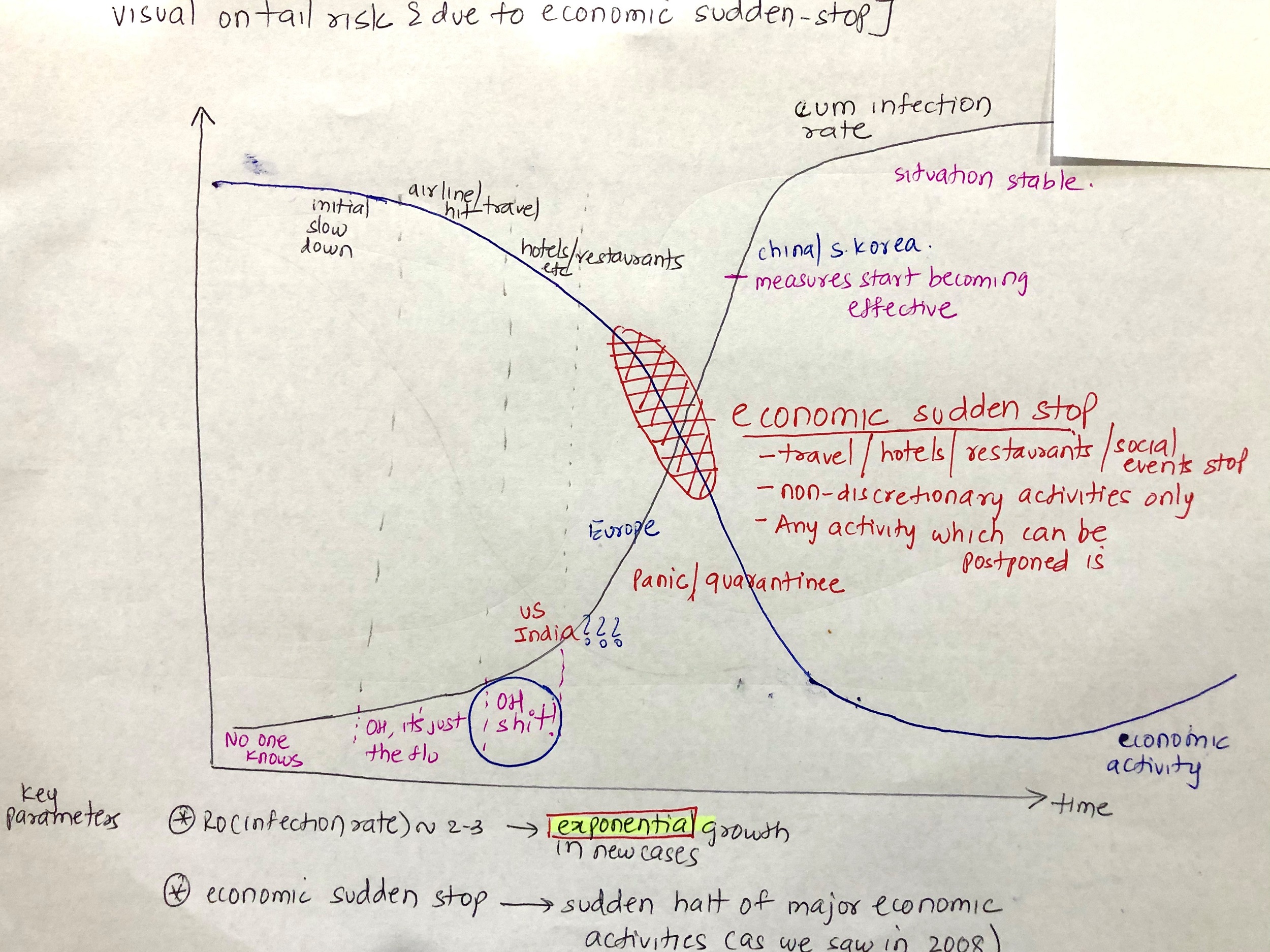

In March 2020, during the depth of the Covid crisis, I did a bankruptcy risk analysis of all my positions. I wanted to evaluate, how long these companies would survive, under various lockdown scenarios such as a drop in topline by 50% or zero revenue for an extended period

Although the severity of the crisis turned out to be much lower, there was a non zero probability that the pandemic could get worse and cause a longer shutdown

I used the recent financial results and credit rating report for the analysis. The review was broken down into break even analysis (how long the company could survive on zero revenue) and long term demand/business impact

Getting a grip on the risk

This analysis allowed me to evaluate the risk of individual positions, their correlations and not to panic at the bottom. At the same time, it also prevented me from being sanguine about the risks.

The benefit of this exercise was that i able to avoid selling at the bottom and started adding to the model portfolio in steady /regular fashion from Mid April 2020 as the worst case scenario did not play out. This analysis continued to help me in subsequent waves of the pandemic as I had already done the work of evaluating the worst case scenario

Although this was a stressful exercise done in the middle of all the uncertainty, it allowed me behave more rationally and in a measured fashion. For me, there was never a eureka/light bulb moment when I decided to go all in. As I shared in my earlier post, my top priority was return of capital than return ON capital

Following is a sample of the analysis and are my raw notes. This is no longer in the portfolio (as shared in the prior post – a mistake) and also not a recommendation to buy or sell

April 2020 : Thomas cook (I) ltd [Company is in the travel space – epicentre of the crisis]

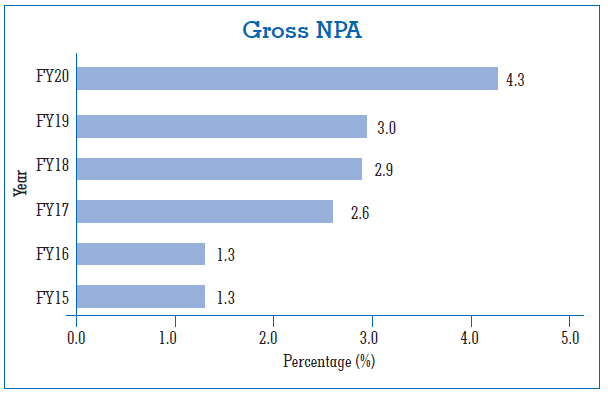

Liquidity risk: CRISIL AA-/Negative as of 3/27

Crisil report: Liquidity Strong

Liquidity remains strong, with cash and cash equivalents of Rs 1,724 crore as on December 31, 2019, against repayment obligation of Rs 73 crore over the 12 months till December 31, 2020. Liquidity is driven by the nature of operations with significant advances from customers. Financial flexibility is enhanced by the ability to contract short- and long-term debt at competitive rates. On a standalone level, TCIL has no long-term debt, and working capital limit has been sparsely utilised. Its subsidiaries are expected to service debt through internal accrual and need-based support from TCIL.

CRISIL believes TCIL’s profitability and cash flow metrics could be materially impacted by continued travel restrictions due to prolonged Covid-19 situation.

Cash burn rate: Company has a cash outflow of around 250-300 Crs/ quarter from salaries, overhead and other expenses. Company has used up around 150 crs of surplus cash. Float is likely to drop. With full stoppage of travel company is likely to lose 200 Crs in Q1 and around 200-250 crs in assuming travel starts picking up end of year slowly. Company has cash and equivalent of 1700 crs, free cash of 200 crs (50 crs after buyback) and only 75 Crs of re-payment till end of the year

Assuming 50% drop in topline, company could lose atleast 500-600 Crs this year. Can take on debt of 400-500 crs including loans/ funding from parent to sustain the year. Some recovery could happen in 2021 and 2022 could see return to normalcy

Break even analysis

Company has a GPM of around 25%. Company needs 1200-1400 Crs of cash flow for Break even basis. Based on this, the company will achieve cash flow break even with 25% drop in topline. Due to the severe stoppage of travel and tourism, even this is not likely. Q1 could see almost 70% drop and Q2 could at best be 40% of capacity. Normalcy will only return from Q3 onwards.

In view of this, the company will need close to 800-900 crs of cash flow and will need to take on 500 -700 crs of debt at a minimum to support the operations.

Long term demand/ Business model impact

Short term fragility is from complete stoppage of travel/forex, MICE events etc. Long term risks/ fragility comes from OTL and move to online travel, which for now is lower risk and with tightening of capital, could reduce.