There is virtue in being patient, more so if you are a long term investor. I got a taste of this lesson again, recently with tata steel.

I had been analyzing tata steel for a few weeks and got extremely tempted when the stock hit 400 Rs a share. I would have pulled the trigger on this one, but decided to follow a time tested approach – Never buy a stock when you are in heat J

I usually spend a few weeks analyzing a stock. Once I have completed the first round of analysis, I leave it and try to come back to it after a few days or weeks. The advantage of this approach is that it allows me to sort of cool down and get a little more rational. It helps in reducing the adrenaline surge I get when I am looking at a good business, which also seems to be quite cheap.

The story behind tata steel

Tata steel is one of oldest steels companies in India. It has a capacity of around 6.8 MMT (million metric tons), mostly in Jamshedpur. In addition the company has a Brownfield project of around 3MMT at the same location, due in 2012 and another Greenfield project coming up in Orissa in around 2014.

Tata steel India is one of the most profitable steel companies in the world with operating margins in excess of 30%. Iron ore and coal accounts for almost 60% or more of the cost of production. Tata steel owns its own mines and thus has been shielded from the rise in the cost of iron ore and coal. In addition, it is also an operationally well managed company.

The Corus acquisition

Tata steel acquired Corus in 2007. You can read about it here. Tata steel announced its intention to acquire Corus in 2006 and then got into a bidding war with CSN and eventually paid 12 billion dollars (around 55000 Crs) for the company. You can read about Corus here.

Corus has three integrated steel plants in UK and Netherlands. In addition, the company also has multiple rolling mills and manufacturing locations across Europe. The company had around 50000 employees at the time of acquisition which has come down since then due to layoffs, restructuring and closure /sales of some facilities.

Tata steel invested around 3.7 billion (around 17500 Crs) in the form of equity and bridge loan. The rest was financed via an LBO (the acquired company took the debt on its balance sheet). So at the end of the transaction, tata steel at a consolidated level had a debt of around 54000 Crs against equity of 34000 Crs.

I am not as smart as the Tata steel managers or the banker who advised them, so I still cannot figure how this was a good deal for the shareholders. The Indian shareholder paid around 9 times EBDITA for the Corus. In addition, they used the stock of tata steel to pay for it, which is a far more profitable company than Corus ( Tata steel India had an EBDITA of 511$/ tonne of steel where as tata steel Europe had an EBDITA of 122$/ tonne in Q12012).

Anyway, after the deal happened we had the financial crisis and the deal which appeared pricey to begin with, now looked like a complete disaster.

So what interested me ?

As I said earlier, the management of the company is very good from an operational standpoint (capital allocation is a different matter). The management has been energetic and proactive in tackling the problems in the European operations.

The high cost structure in Europe is being attacked by closing/ selling facilities. In addition there have been layoffs and work force reduction to improve the labor productivity. As a result of these ongoing improvements, the European operations is no longer losing money and has actually started making some money now. If Europe does not have a severe crisis due to Greece and other PIIGS countries (and it is a big if), then tata steel Europe should be reasonably profitable in the next few years

The management has also gone ahead and improved the capital structure by selling some non core assets such as shares in other tata group companies, interest in Riverdale mining etc. The net Debt to equity ratio is down to 1:1 in the current quarter and is likely to improve further. As a result the balance sheet is much stronger and can withstand a recession better than it could in 2008.

So what scares me?

As I said earlier in the post, the ongoing improvements in Europe and the new capacity in India (which will raise total capacity by 50% in the near future) got me all excited. I decided to cool it down and wait for a few days as I continued to dig further into the balance sheet .

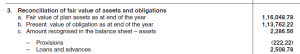

I came across the following , for the post retirement pension plan (pg 218 of 2011 annual report). The numbers below are in crores.

Look at the above number and ponder on it for a minute.

Tata steel has a networth of around 35000 Cr last year and made a net profit of around 9000 Crores in 2011. The pension liability is 3 times the networth and 12 times the annual profit.

I cannot give a lesson on pension liability accounting in this post, but let me give a few points to think about.

The pension liabilities are covered by assets (think money set aside to pay for the pension) .In a happy situation as above, where the assets exceed the liability, the company gets to carry a positive balance on its balance. If however the market weakens and the assets drop or do not earn the expected rate of return, then the difference is carried as a liability on the balance sheet.

As per Indian accounting, a company has to take this liability through its profit and loss and show a loss if required. However tata steel, very conveniently, decided to opt for UK accounting standards and carries the liability on its balance sheet alone. Now this is perfectly legal and there is no hanky panky in it.

In addition overtime, if this gap keeps growing, the company is required to cover the difference by charging the shortfall to the profits and by adding capital to the assets (set more money aside) . If you are thinking that the company can get away from it, think twice. This is a defined benefit plan – which means the workers have to be paid their pension, irrespective of the returns on the assets.

The liabilities are solid and will grow at a fixed rate. The growth in the assets depends on the returns on the stocks and bonds, which is anything but fixed. Finally this is Europe – you cannot get away from such liabilities at all (short of bankruptcy)

Where’s the risk

The assets under the pension plan cover the liabilities for now. However the gap is less than 2% now. How can we be sure that that the assumed returns on the asset (4.25-9.25%) will not turn out to be optimistic ? If that happens, then tata steel has a huge bill to foot in the coming years.

I am personally quite uncomfortable with this kind of an open ended liability. It is difficult even for the management to predict what will happen as it depends on the returns they will get on the assets (stocks and bonds) in the future. If there is a shortfall, the picture could get very ugly for the shareholders

So why is no one talking about it?

I think I know the reason for this. This is a long term, contingent liability. The shortfall may or may never happen. If you are an analyst, recommending the stock for the next 3-6 months, this kind of liability does not matter. If something does happen, you can always say – oops J

If however, you are a long term investor like me, such liabilities can make a big difference, especially if you cannot evaluate it with confidence. I have not given up completely on this – I have uploaded a sum of the parts valuation for tata steel here (pls have a look and leave me any feedback you may have)

Controlling my testosterone

As I said in my previous post, one of the key points for me as an investor is to manage my emotions and first conclusion bias. I generally try to stagger my analysis and purchase so that I can avoid the first conclusion bias and then the commitment and consistency bias, which kicks in after the first purchase.

In the above case, I have found a liability which may turn out to be immaterial eventually. At the same time, even if the probalitlity is low, the downside is very high if it is does materialize. This liability is in addition to the 40000 cr debt already held on the balance sheet and weak European operations . All these liabilities are supported by the highly profitable Indian operations. Lets hope they stay strong !