The following was posted to all the subscribers. Hope you find it useful

Market drops have become a once in two year events

2016 – demonetization (note here)

2018 – ILFS crisis (note here)

2020 – Covid Crisis (note here)

2022 – Drop in US markets and now Russia Ukraine war

There is no regularity to these events and does not mean we will get these drops in even years. Such drops have occurred in the past and will occur in the future too.

You have to study the market history to know that there is always something to worry about and scare the markets

Bottoms instead of top down

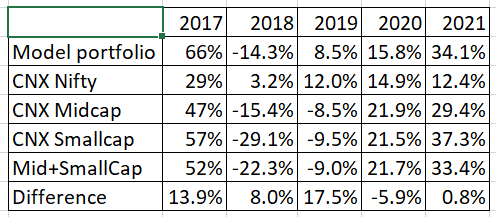

I have never planned the portfolio based on some specific forecast or event. In the last 11 years of our advisory, we have seen all kinds of micro and macro events occur. At that time, the event appeared to be a big deal and then eventually everyone adapted to the new situation

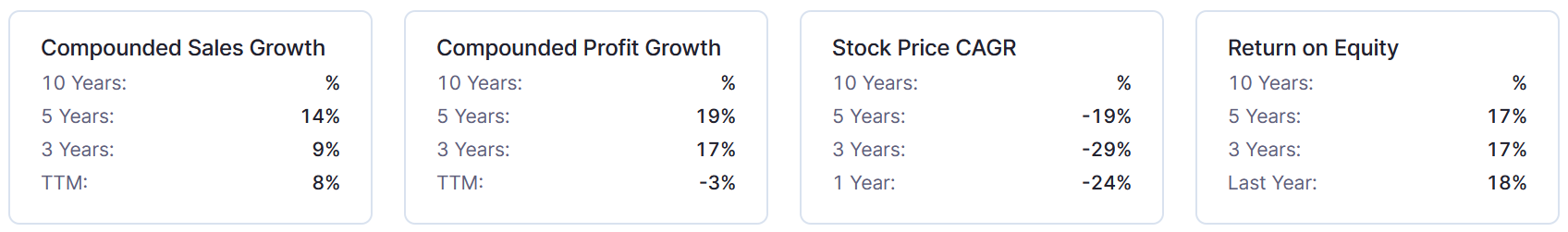

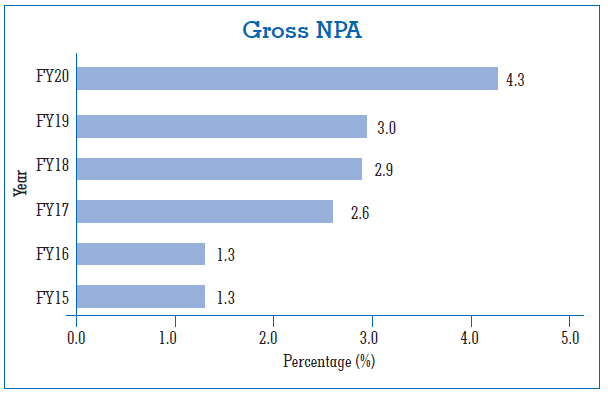

What I have changed in the recent past (as I noted in the annual letter) is my response to company level events. If a company is not doing well or the management is lacking in execution, we would rather exit than hope things will work out

Doing so ensures that we clear the portfolio of its deadwood and have positions with higher level of conviction. That’s the reason we have 25% cash level in the portfolio, not because my crystal ball forecasted a downturn in 2022

What does the crystal ball say now?

My crystal ball is as murky as it always has been. The same is true for others, even if they claim otherwise

However, a few long term trends which impact investors the most, seem to standout. Inflation and by proxy interest rates appear to have bottomed and could rise in the future. This will exert a downward pressure on valuations.

Commodity prices and supply chains will continue to get disrupted due to this conflict and other geopolitical events

All of this means a lot more volatility in businesses and stock prices

How to invest with higher volatility

In my mind higher volatility means that managements of companies will have to be flexible and adapt faster to change. For us as investors, this means that the operating environment for our companies could change suddenly leading to a break in our thesis

When that happens, we may have to sell and move on. Holding onto an outdated thesis and hoping it works out is a recipe for disaster

We have been doing that for the last 6 months and will continue to do so. I am not counting on luck to bail me out.

The second change is portfolio diversification across companies and sectors. I have tried to spread out our investments across companies and sectors to ensure that a hit in one does not derail the portfolio. The same holds true for your overall portfolio outside of equities. I would recommend being diversified across asset classes with allocation adjusted to your personal situation

A plan of action

A lot of you have asked if you should add to positions which have dropped below the buy price. The simple answer is Yes. The only time when this happens is when there is chaos and crisis in the world. Such prices come only during times of trouble

It does not mean that if you start adding today, you will not see lower prices. No one can predict how low the markets can go and when they will turn around.

This is the price of investing in equities and no matter what system you follow, there will always be losses from time to time. you can use a stop loss but then on the flip side if the market suddenly turns, you will lose the upside.

The best option is to invest in a steady and measured way keeping in mind that your purchases could show a loss in the short to medium term. Invest only if you don’t need that money for the next 3-5 years and the amount is such that these losses will not cause you to lose sleep

We continue to look for new ideas and with the recent drop, a few are becoming attractive by the day.

As always, our money is invested the same as the model portfolio and we continue to eat our own cooking