I am posting my analysis of Linc limited. Please note this is not a buy/sell recommendation and is only for educational purpose.

You can download the report from this link: Linc Limited

Please read the disclosure at the bottom of the report

I am posting my analysis of Linc limited. Please note this is not a buy/sell recommendation and is only for educational purpose.

You can download the report from this link: Linc Limited

Please read the disclosure at the bottom of the report

I am posting my analysis of Ador welding limited. Please note this is not a buy/sell recommendation and is only for educational purpose.

You can download the report from this link: Ador welding limited

Please read the disclosure at the bottom of the report

I am posting my analysis of Equitas small finance bank. Please note this is not a buy/sell recommendation and is only for educational purpose.

You can download the report from this link: Equitas small finance bank

Please read the disclosure at the bottom of the report

The Defense sector has caught investor fancy, with stocks such as GRSE, Hindustan aeronautics and Cochin shipyard, running up in the recent months

The following factors are supposed to be the key drivers for it

These factors have been in place for the last few years, but are gaining momentum now (achieving critical mass)

We initiated a position in Cochin shipyard in 2020 in the model portfolio which turned out to be early in Hindsight. The main driver was an increasing order book driven by the above factors. As it happens with anything related to the government – You can count on delays inspite of the best intentions. As a result, we exited the position to avoid opportunity loss

This sector continues to be on my radar, though we have no position in it

I am publishing the research report from 2020, as the thesis is unchanged. You can download it from here

I am posting my analysis of Bector Foods. Please note this is not a buy/sell recommendation and is only for educational purpose.

You can download the report from this link : Mrs. Bectors Food Specialities Ltd

Please read the disclosure at the bottom of the report

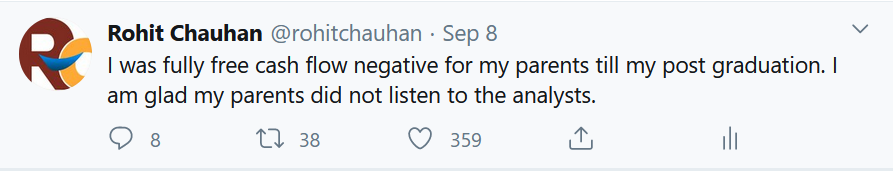

I tweeted the following half-jokingly

This is in response to comments from investors and analysts where they raise a red flag on a company with negative free cash flow, without further analysis.

What’s free cash flow

Let’s define free cash flow for a business

Free cash flow = Operating cash flow (including depreciation) – Maintenance capex

Maintenance capex is defined as capital required by a business to maintain its unit volume and competitive position. This capex would be in the form of working capital and fixed assets.

Let’s take a simplified example to illustrate it. Let’s say you own a house on your own piece of land (a rarity but go with me on this one). After a few years, you decide to get the house repainted as the old paint is peeling off and there are cracks in the wall. Let’s say you spend 5 lacs on the whole thing.

After the house is painted and repaired, you feel good about it. Keep in mind that the value of the house hasn’t gone up. If you were to list the house it would not sell for more (though it could have sold for less if the repairs had not been done).

Let’s fast forward a few years. You decide to extend your house and build a new room. The square footage of the house goes up by 15%. If you decide to sell the house now, you will be able to get a higher price for the house as the area of the house has increased.

The first scenario is that of maintenance capex – money spent to maintain value of the asset. The second is the case of growth capex – money spent to increase the value of the asset.

No published numbers

The same point holds true for a business/ company. The only difference is that a company will rarely break out the annual investment into maintenance and growth capex. This is something an investor has to figure out based on a study of the business.

Investors look at the cash flow statement with the following math

Operating cash flow + depreciation – working capital investment – fixed asset investment

If the above number is negative, they flag it as an issue. The problem here is that the investor is not distinguishing between growth and maintenance capex.

Any money spent on maintenance capex does not increase the value of the business. If all the investment in the above equation is maintenance capex and the resulting number is negative, then it is a red flag.

A lot of businesses, especially in the commodity space, have to keep investing just to stay in the same place from a competitive position. That’s the main reason why these businesses do not create value for their investors over a business cycle.

A company in growth phase and investing into growth capex, will also have negative free cash flow which could create value down the road.

How to evaluate growth capex

This requires a detailed understanding of the business and competence of the management.

There are businesses which requires very little maintenance capex (almost equal to depreciation) and re-invest all their free cash flow for growth and at high rates of return. Such businesses create a lot of wealth for their shareholders in the long run.

The key point to evaluate is whether the investment is being above the cost of capital (including debt). If yes, then you want the management to invest as much as it can (within reasonable limits) as these incremental investments will create value for us down the road.

The main job of the analyst is to figure out whether the management is truly investing above the cost of capital. That unfortunately cannot be accurately estimated to a decimal point, though there are indicators which can help you make an educated guess. You need to ask questions on the attractiveness of the industry, the opportunity size and capability of the management (based on past performance) and come up with a rough guess.

The next time you hear someone talk of negative free cash flow without an analysis of growth v/s maintenance capex – you can recall my tweet above. Such a person is implying that spending on education is a red flag as there no free cash flow being generated in the present.

Starting note: This is a long post and I am going to cover a lot of ground. I have tried to cover a vast topic in a few pages, which is usually the subject of entire books. As a result, I have tried to simplify and generalize in several cases to make a point.

In the previous post, I tried to make the point that it is not enough to say that a company has a moat and then rush to your broker to put in an order. One needs to answer a couple of questions

Do not focus too much on the math

I received a few emails asking me about the calculations on how I arrived at the PE ratios. As I said in my previous post, the math is not important for the point I am making – longer a company earns above its cost of capital, higher is its intrinsic value.

I would suggest that you use the standard DCF model and apply whatever assumptions you like for growth, ROE, free cash flow etc and just play around with the duration of the moat or the period for which the company can earn above the cost of capital. It should be quite obvious that longer the duration, higher is the value of the company.

For the really curious, I have uploaded my calculations here. Prepare to be underwhelmed!

Market implied duration

The other point i would like to make is by turning around the equation – If the company has a high PE ratio, the market is telling you that it expects the company to earn above its cost of capital for a long time.

For illustration, let’s take the example of Page industries (past numbers from money control, future numbers are my guess).

Future expected ROE = 50% (roughly 53% in 2014)

Future growth rate = 30% (40% growth in 2010-2014)

Terminal PE = 15

Current price = 14000 (approximately)

If I put in these numbers into DCF formulae, I get a Moat period of around 10 years.

So the market expects the company to grow its profit by 30% per annum for the next 10 years and maintain its current return on capital. This means that the company will earn a profit of 2000 crs by 2025.

So do I think that page industries will maintain its moat for 10 years or longer and grow at 30%?

I don’t know !

However if I did own the stock or planned to buy it, my next step would be to analyze the competitive strength of the company and see if the moat would survive 10 years and beyond, because if it didn’t I would be in trouble as a long term investor.

Precision not possible

In the previous example I used a fancy formulae and a long list of assumptions to suggest that the market considers page industries to have a competitive advantage period or moat (CAP for short) of 10 years.

Once you put a number to some of these fuzzy concepts, it appears that you have solved the problem and are ready to execute.

Nothing could be farther from the truth.

Anytime someone tries to give you a precise number on intrinsic value of a company, look for the assumptions behind it. As you may have read, the best tool for fiction is the spreadsheet.

The above calculation should be the starting and not the end point of your thinking. I typically do the above kind of analysis to look at what the market is assuming and put it into three broad buckets

2-5 years : Market assumes a short duration moat

5-8 years : Market assumes a medium duration moat

8+ years : Market assumes a long duration moat (bullet proof franchise)

Let’s look at some way to analyze the moat and bucket it in some cases

Measuring the moat

A substantial part of my post has been picked up from this note by Michael Mauboussin. The first version of this note was published in around 2002 and the revised one in 2013 (download from here)

If you are truly interested in learning how to discover and measure moats, I cannot stress this note enough (some important parts in the note have been highlighted by me) . Read it and then re-read it a couple of times. The only point missing from this note is the application of the concepts – Michael mauboussion does not provide any detailed examples of applying the concepts to a real life example.

Model 1: Porter’s five forces analysis

I am not going to write a detailed explanation of this model – you can find this here. I have used this model to analyze IT companies in the past – see here. A few more posts on the same topic can be found hereand here.

Let me try to explain my approach using an example from the past. Lakshmi machine works was an old position for me (I no longer hold it). As part of the analysis, I did the five forces review of the company/ industry which can be downloaded from here

A few key points about the analysis

The above is also visible in the form of a very high return on capital for LMW – The company had a negative working capital for 10+ years and earned 100% + on invested capital at the time of this analysis

As I analyzed the company in 2008, I felt strongly that the company had a medium (5-8) or a long duration moat. It was not important to arrive at a precise number then, as the company was selling at close to cash on books and the business was available for free. Surely a business with a medium term moat was worth more than 0 !

Model 2: Sources of added value

The second mental model i frequently use is the sources of added value – production advantages, customer advantages and government (pages 34-41 of the note)

I have uploaded the analysis for CERA sanitary ware (current holding), I had done in 2011. Look at the rows 14-19 for the details.

A few points to note

Model 3: High pricing power

Another key indicator of competitive advantage is the presence of pricing power. The following comment from warren buffett encapsulates it

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price 10 percent, then you’ve got a terrible business.”

How do you evaluate this ? Look for clues in the annual report or management responses to questions in conference calls. Does the management talk of margins being impacted severely due to cost pressures ?

For example – Companies like Page industries or asian paints are generally able to pass through cost increases to customer without losing volumes. When the input costs drop they can either increase their margins or use this excess profit in advertising and promotions and thus strengthen their competitive position. Can steel or cement companies do the same ?

Other miscellaneous models

A brief synthesis

I have laid out various models of evaluating the competitive advantage of a company. Once you go through this exercise, you can arrive at a few broad conclusions

No moat: A majority of the companies do not have a moat. As you go through the above models and are hard pressed to find anything positive, it is an indicator that the company has no competitive advantage. Even if the company has been earning a high return on capital in the recent past, it could be a cyclical or temporary phenomenon. Look at several commodity companies which did well in the 2006-2008 time frame, only to go down after that.

Weak moats : If the moat depends on single a production side advantage such as access to key raw material or government regulation, it’s a weak moat (think mining or telecom companies). The company can lose the advantage at the stroke of a pen, law or whims and fancy of our politicians. In addition the pricing power of such companies is very low. I would categorize such a moat as a weak one and not give it a duration of more than 2-3 years.

Strong, but not quite : If the moat depends on customer advantages such as brands or distribution network, the moat is much stronger. A company with a new brand which is either no.1 or no.2 has a much stronger moat. I tend to give the moat a medium duration (5-8 years). The reason for being cautious at this stage is that the company clearly has a competitive advantage, but the strength has not been tested over multiple business cycle. In addition, in some case the business environment is subject to change and one cannot be too confident of the durability of the moat. The example of LMW or CERA in the past is a good one for this bucket

The bullet proof franchise :These are companies with multiple customer and production (scale related) advantages. These companies are able to command high margins, can raise prices and at the same time have a very competitive cost structures due to economies of scale. These companies have demonstrated high returns of capital over 10+ years and continue to do so. In such cases, one can assume that duration of the moat is 10+ years. These cases are actually quite easy to identify – asian paints, nestle, Unilevers, pidilite, HDFC twins and so on.

Moats are not static

A key point to keep in mind is that moats are not static, but changing constantly. In some cases the moat can disappear overnight if it depends on the government regulation (such as mine licenses), but usually the change is slow and imperceptible and hence easy to miss.

If you can identify the key drivers of a company’s moat, then you can track those driver to evaluate if the management is strengthening or weakening the moat. For example, the moat of an FMCG company is driven by its brands and distribution network. As a result, it is important to track if the management is investing in the brand and deepening/ widening the distribution network.

In the case of LMW, I think the moat has slowly shrunk due to the entry of Reiter ltd. Reiter was the technology partner and equity holder in LMW. The two companies have since parted ways and Reiter is now competing aggressively in the same space.

LMW has repeatedly indicated that they are now facing a higher level of competition in India and consequently there has been a slow drop in operating profit margins. In addition one can see an increase in the working capital usage too. I cannot precisely state that the moat duration has shrunk from 10.7 years to 6.3 years, but there is increasing evidence that the moat is under pressure. As a result, I exited the stock a few years back.

Putting it all together

Let’s assume that you have done a lot of work and figured out that company has moderate moat possibly 5-8 years. At this point, you can plug in the required variables into a DCF model and analyze the market implied duration of the moat (the way we did for Page industries)

If the market thinks that the company has no moat or a minimal moat, than you have a probable buy. If however the market implied moat is 10+ years, then the decision would be to avoid buying the stock, not matter how good the company

The above sounds simple in theory, but is far more difficult in practice – I never promised that I will be giving you a neat, fool proof formulae of making a lot of money by doing minimal work 🙂

The moat of a long term investor

If the all of the above sounds too fuzzy and cannot be laid out in a neat formulae, you should actually feel very happy about it. Think about it for a moment – if something is fuzzy and requires a combination of a wide experience, insight and some thinking, it is unlikely to be done successfully by a computer or fresh out of college analysts.

Can a research analyst go and present this fuzzy thinking to his head of research, who wants a precise target price for the next month ?

So any investor who has a long term horizon and is ready to invest the time and effort to do this type of analysis will find very little competition. It is a general rule of business that lower competition leads to higher returns – the same is true for investing too.

If you buys stocks, the way most people buy shoes, TV or fridges – after due research on features, durability (how long the consumer durable will last) and then compare with price, the result will be much better than average

—————-

Stocks discussed in this post are for educational purpose only and not recommendations to buy or sell. Please contact a certified investment adviser for your investment decisions. Please read disclaimer towards the end of blog.

Stocks discussed in this post are for educational purpose only and not recommendations to buy or sell. Please read disclaimer at the bottom of blog.

Stocks discussed in this post are for educational purpose only and not recommendations to buy or sell. Please read disclaimer at the bottom of blog.