I wrote this note over the weekend to my subscribers. This is a hypothesis based on how events have played out across countries. Things could get better, but the probability of that happening in the near term keeps reducing by the day. We are seeing the first order and maybe the second order impact of the Pandemic.

————————–

What is an economic sudden stop – It is when most economics activities for a location come to a sudden stop due to a financial or natural disaster. In most cases such sudden stops are local such as due to a flood or an earthquake.

On rare occasions we get economic sudden stops at country level due to economic reasons – think of Asian currency crises in 1997.

Global sudden stops are extremely rare and have happened only during the great depression in 1930s and 2008. Even during wars, we do not have such a situation.

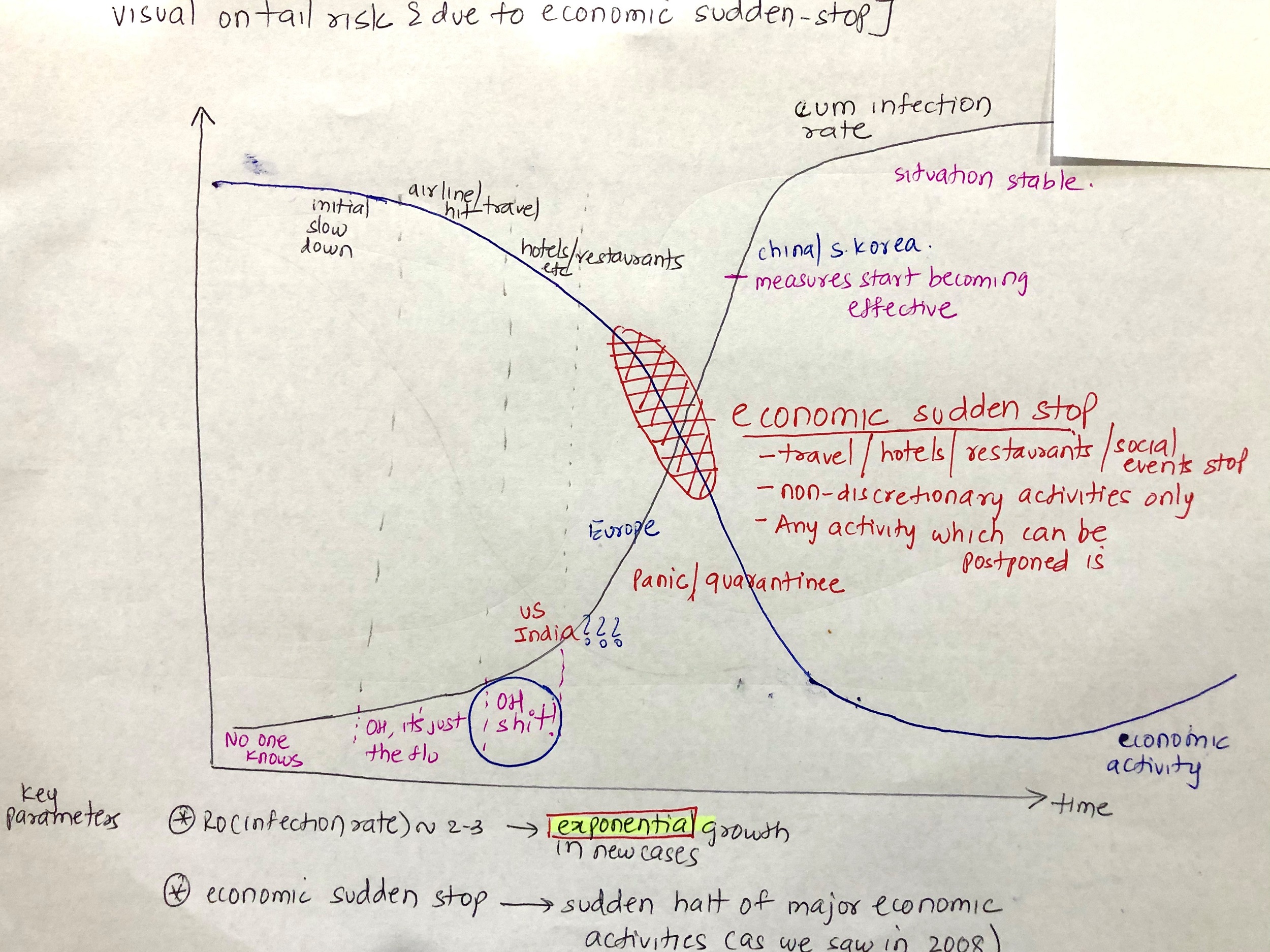

The current crises has the potential of an economic sudden stop (and may have started). I have been thinking of this risk (which I have been referred to as a Tail risk). Over the weekend, I drew the following crude picture to illustrate my hypothesis (please excuse my drawing).

Key points

- Due to the exponential nature of the spread of this infection, most countries have under-reacted in the beginning.

- Once the numbers cross the threshold, a country has an Oh shit ! moment. US and Europe had it last week. I don’t think India has had it yet.

- Once we cross this moment, we enter the panic phase quickly where all economic activity slows down dramatically as the country stops travel, and all kinds of social and business events which involve more than a handful of people (update : US has banned all events for > 50 people)

- We will not see a gradual slowdown of economic activity. It will drop off the cliff.

- As you can see from the picture, economic activity will resume (slowly) as the situation normalizes. As of today, we cannot predict when it will happen as it depends on both the domestic and International situation.

- This is a major event and will permanently change the behavior of Individuals and Countries. Its too early to predict what will happen

Action plan

- The focus should be on making through this event – both health-wise (both self and family) and financially

- As I shared earlier, I will not try to rush into the market based on valuations alone. Depending on how things play out, the financials and even viability of a lot of business will change

Any particular sector where you think the viability may change, such that they don’t recover from this setback?