I shared the following note with subscribers on how the current trends in solar/wind power and battery technology are likely to cause disruption in the energy markets. The impact of this disruption is already being felt in the capital goods sector, which is an early proxy of the long term trends in an industry. Any management planning to invest with a 20 year horizon will carefully analyze the long trends before committing capital for this duration..

I have kept out the name of the company we hold, for obvious reasons, but the conclusions are valid for any company in the energy sector value chain. In addition, I think these technologies are likely to have a huge impact in the transportation, oil & gas, coal, power storage and other industries too

——————————–

I highlighted the following risk in 2016 for our holding.

Solar energy – I wrote extensively about it in the previous year’s update and the solar energy market continues to develop as expected. It is critical to track this sector as solar is a substitute for other forms of energy (such as coal or Oil) and hence its adoption will have some impact on the demand for the products of the company.

The company continues to focus on process co-gen, waste to energy (including biomass based power generation) and the IPP sector. As I wrote in the previous update, the first two sectors continue to do well as they serve as a complementary power generation system. The IPP segment however is under threat as solar can easily displace this at a lower cost and the company’s performance seems to bear this out.

I have been tracking the renewable and battery/ storage space for the last few years. Let me share some data points before discussing the implications

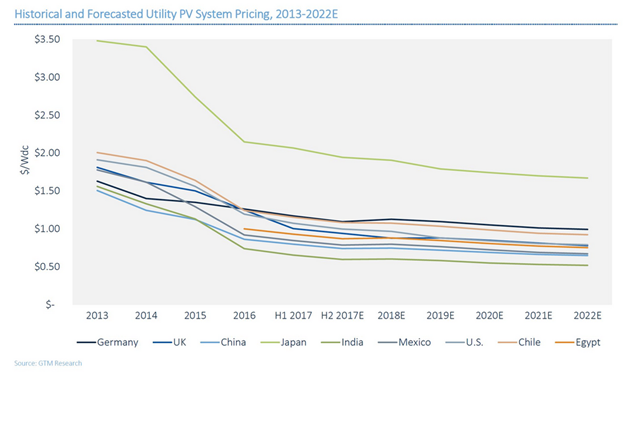

The graph below shows the price trends for the next 5 years. Please keep in mind that the drops in the recent years have been much higher than predicted and there is no reason why the current rate of 15% annual price drop will not continue

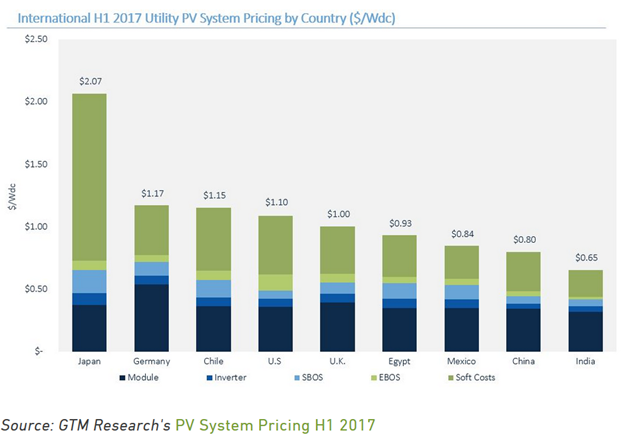

This is a comparative cost across countries

As you can see, India has the lowest costs due to lower soft costs (aka labor costs).

The recent solar auctions in India and several parts of the world are now hitting the 1.3-1.5 Re/KWH levels already and this is expected to drop further. In comparison, the cheapest fossil fuel generated power – Coal, is priced at around 3 Rs/KWH and rising due to transport and other costs

At this point, a lot of naysayers, point out the lack of storage and intermittency of solar and wind power. Let’s look at another data point – Cost of lithium ion storage. This has now hit 200 dollars/ Kwh and continues to drop by around 15% per annum. At the current rate, the cost ofs batteries will drop below 100$/ KWH in 3 years. Why is 100$/KWH important?

This is the point at which solar + Large scale storage start becoming cost competitive with base load or Coal based power. Again, keep in mind that these trends will not stop in 2020, but will keep continuing beyond that due to economies of scale and new research (in other forms of batteries such flow batteries, Lithium air etc)

Is this all hypothetical?

We may assume that all this is theory and the energy markets are yet to be disrupted. That is not true and we already have a few early signs of disruption

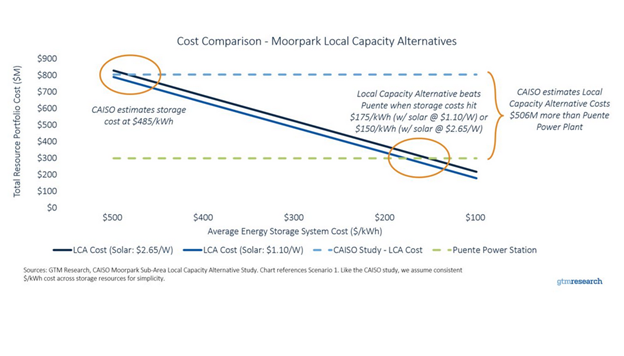

a. Gas based Peaker plants (which take care of sudden spike in demand for electricity) are not being built as it is cheaper to use battery storage to take care of such spikes

b. Companies like GE and Siemens have seen a large drop in demand for gas turbines and announced re-structuring of their power business.

c. What natural gas did to coal, will be repeated again

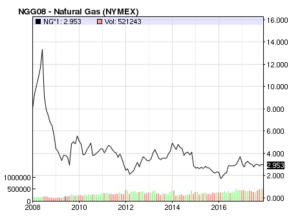

In 2012-14, we had a new technology called fracking reach scale in the US. This technology had been in development for almost a decade and hit an inflection point in 2014. The resulting glut in natural gas led to a sharp drop in the price as can be seen in the chart below.

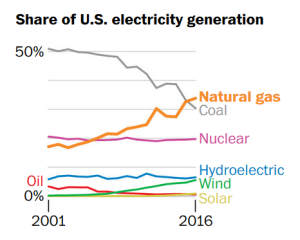

The result of this drop was that, natural gas suddenly became cheaper (and cleaner) than coal and caused a switch in fuel for power generation. This can be seen in the picture below. This in turn led to a drop in the demand and price of coal, leading to large scale bankruptcies in the coal sector in the US

Keep in mind that fracking only works if you already have deposits of gas/ oil in place, but were uneconomical earlier. There is no such limitation for solar or wind energy.

Please ignore the S curve

Lets go back to the first principles in economics – People respond to incentives. Companies, individuals and governments are not going to switch to solar or wind energy because they have suddenly realized that these are green technologies, but the because these technologies are now becoming cheaper than the alternatives (fossil fuel).

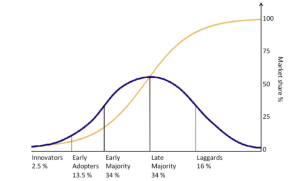

We still have a lot of naysayers including some of the think tanks, who keep suggesting that these disruptions are atleast 15-20 years away. If you look at the numbers, for some reason their predictions assume that the price drop in these technologies will change from the current 15%+ to around 3-5% due to which the uptake of these technologies will proceed in a linear fashion.

You can believe these predictions if you are ready to ignore the S-curve model of adoption, which states that these kind of non-linear technologies follow an exponential adoption rate till they hit saturation.

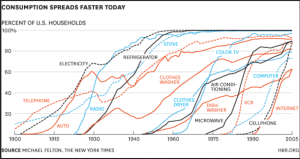

Look at the example of cell phones, internet, Computers and so on which show the adoption rates are only speeding up, not slowing down !

We cannot predict precisely when the inflection will occur. However, it is not difficult to see the disruption ahead. At the current valuations, the market is not discounting the threat of disruption for companies in the capital goods sector, oil & Gas, automotive, power and coal sector.

We can wait till the threat becomes obvious and then exit our positions. I am however not inclined to wait till the last minute before jumping off the track, even though I can dimly see the train coming towards us.